Market Capsule 24th August '24 | ATH On Small Cap Index

- samarwealth

- Aug 25, 2024

- 5 min read

Nifty Small Cap 250 index outperformed, gaining 4% this week and touching an all time high of 18096 on Thursday. Top gainers included Minda Corporation Ltd up by 17%, PCBL Ltd up by 11%, Himadri Speciality Chemical Ltd up by 9%, and Doms Industries Ltd up by 8% last week

NIFTY Consumer Durables, PSU Bank, and Metal led with 3% gains, while Pharma, FMCG, and Financial Services each increased by 2%. NIFTY Realty was the only loser, declining by over 2%.

The domestic stock market saw steady gains throughout the week, with Sensex and Nifty closing higher each day except Friday. After a flat start on Monday, both indices climbed consistently, supported by gains in key sectors. By the end of the week, the Sensex had risen to 81,086.21, and the Nifty to 24,823.15, reflecting a positive market sentiment with a cumulative increase across all trading sessions.

Next week, stock markets are expected to react to US Fed Chair Jerome Powell's speech at the Jackson Hole symposium. With no major domestic triggers, global trends will guide Indian markets, which are currently trading above the 20-day simple moving average, indicating a likely continuation of the uptrend.

Charting the Pulse of Indices:

A) Sector Wise Performance

B) Heatmap

Heatmap helps investors quickly understand the performance of multiple stocks or sectors in a single view. Color coding, with varying shades indicating the degree of movement - red for declines, green for gains, and sometimes grey or other colors for little or no change. Heatmaps are effective for spotting market patterns and can be a time-saving resource in investment analysis.

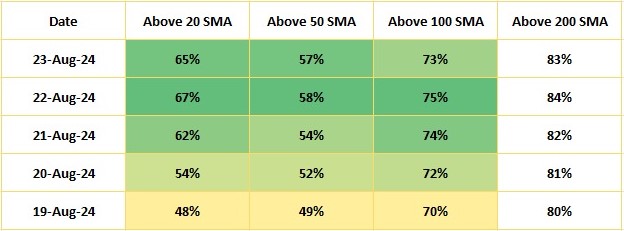

C) Market Breadth

A) Nifty 500

Analyzing market breadth is important as it provides insight into the underlying strength or weakness of the market, beyond just looking at benchmark indices. Breadth measures the percentage of securities in NIFTY 500 surpassing specified moving averages over the specified period. Comparing the market breadth of nifty 500 during the previous week's trading sessions, we can analyze that number of stocks above key moving average support areas are reducing by the end of week. This can be considered as a sign of weakness if change is seen to be significant.

1.Pokarna Ltd

2. TVS Electronics Ltd

3. Century Enka Ltd

4. Uflex Ltd:

5. Affle India Ltd

Corporate Developments

Order Wins:

CWD Limited signed a two-year INR 100 crore Master Supply Agreement with PhonePe to design and manufacture the Sound Box device, enhancing digital payments in India. Link

Mishra Dhatu Nigam Limited (MIDHANI) has secured an order of Rs. 285 Cr. Link

Starlineps Enterprises Ltd has received a Rs. 379.62 million letter of intent from SAKETH IMPEX for the supply of Natural Diamonds.. Link

H.G. Infra Engineering Limited has been declared the L1 bidder by the Ministry of Road Transport and Highways for a ₹711.1 crore project. Link

Avantel Ltd. has received a provisional purchase order worth ₹67.92 crores from NewSpace India Limited. Link

Transformers and Rectifiers (India) Limited has been awarded Export Orders of US $ 16.80 Million. Link

Deep Industries Ltd received a Letter of Award from ONGC for a 3-year contract to provide and maintain skid-mounted gas separation and compression units at Rokhia GCS, Tripura, valued at around ₹63 crores. Link

JNK India Ltd received a significant order from Mundra Petrochem for a Flare Package in the Green PVC Project. . Link

KEC International Ltd secured new orders worth ₹1,079 crores in T&D and Cables businesses. Link

Upcoming IPOs:

Mainboard IPOs:

Premier Energies Limited: The company manufactures integrated solar cells and panels, including modules, EPC solutions, and O&M solutions.

Open Date: 26-08-2024

Close Date: 29-08-2024

Issue Size: ₹2685-2830

Offer Price: ₹427-450

2. ECOS (India) Mobility & Hospitality Limited: The company provides chauffeur-driven car rentals and employee transportation services in India.

Open Date: 28-08-2024

Close Date: 30-08-2024

SME IPOs:

1. Archit Nuwood Industries Limited: The company manufactures MDF, HDF, and pre-laminated boards in various designs.

Open Date: 30-08-2024

Close Date: 03-09-2024

Issue Size: ₹160-168 Cr

Offer Price: ₹257-270

2. Aeron Composite Limited: The company manufactures and supplies FRP products, including pultruded products, molded gratings, and rods for various industrial applications.

Open Date: 28-08-2024

Close Date: 30-08-2024

Issue Size: ₹54.03- 56.10

Offer Price: ₹121-125

3. Paramatrix Technologies Limited:The company offers software applications and technology solutions for large and medium-sized businesses.

Open Date: 27-08-2024

Close Date: 30-08-2024

Issue Size: ₹33.84 Cr

Offer Price: ₹110

4. Jay Bee Laminations Ltd: The company supplies CRGO and CRNGO steel cores.

Open Date: 27-08-2024

Close Date: 29-08-2024

Issue Size: ₹84 - 89 Cr

Offer Price: ₹138-146

5. Indian Phosphate Limited: The company produces LABSA 90%, an anionic surfactant used in washing powders, cakes, toilet cleaners, and liquid detergents.

Open Date: 26-08-2024

Close Date: 29-08-2024

Issue Size: ₹63.36 - 69.36 Cr

Offer Price: ₹94-99

MOUs/Agreements:

RVNL has signed an MoU with Dhaya Maju Infrastructure (Asia) Sdn Berhad (DMIA) to jointly pursue Railway Infrastructure projects in ASEAN and other markets. Link

Nibe Space Pvt Ltd, a subsidiary of Nibe Ltd, has formed a consortium to establish India’s Earth observation satellite constellation, marking National Space Day. Link

JSW Renew Energy Twenty Ltd, a subsidiary of JSW Energy, signed a PPA with BESCOM for 300 MW solar capacity awarded by KREDL. Link

Lemon Tree Hotels Ltd signed a License Agreement for Aurika Hotels & Resorts in Surat, Gujarat. The property, managed by Carnation Hotels, is expected to open in FY 2030. Link

Block/Bulk Deals:

PNB Housing Finance Ltd: General Atlantic Singapore Fund Fii Pte Ltd

sold shares of ₹1,069 crore.

Alkem Laboratories Ltd: Samprada & Nanhamati Singh Family Trust bought shares of ₹487 Cr

Acquisitions:

Power Grid Corporation acquired Rajasthan IV C Power Transmission Ltd to establish a transmission system for Rajasthan REZ Phase IV on a BOOT basis. Link

Updater Services Ltd (UDS) increased its stake in Denave India Pvt Ltd, a material subsidiary, from 67.27% to 89.57% by acquiring 37,48,614 equity shares. Link

Refex Sustainable Solutions Pvt Ltd, a subsidiary of Refex Renewables, will acquire a 51.02% stake in Vyzag Bio-Energy, making it a subsidiary. Link

Ambuja Cements Ltd approved the acquisition of a 100% stake in Penna Cement Industries Ltd by entering into a binding agreement. Link

Bikaji Foods International Ltd acquires a 55% stake in Ariba Foods, making it a subsidiary. Link

That's all for now! I hope you enjoyed the content. Do share your comments below! Disclaimer: Any stock or company discussed above should not be considered as a Buy/Sell recommendation. We personally or our clients might or might not have a position in any of the stocks discussed. This newsletter is purely is for educational purposes only.

Comments